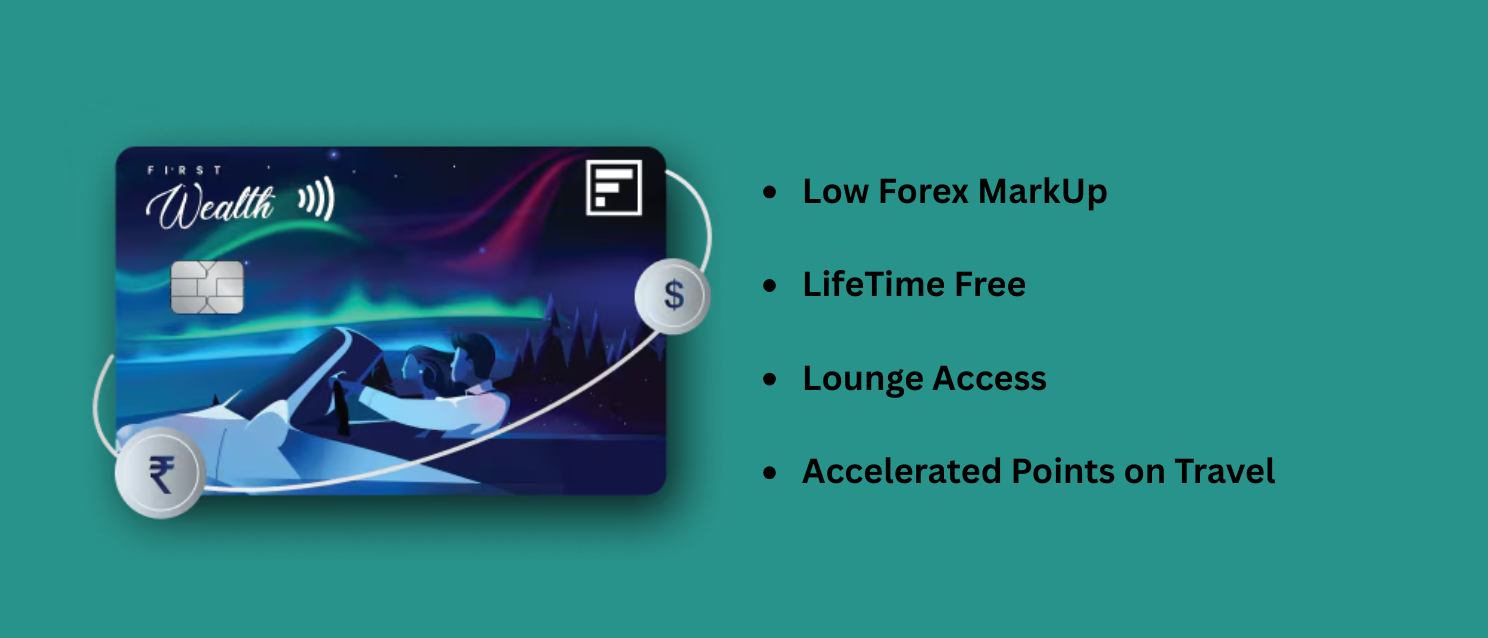

The IDFC FIRST Wealth Credit Card is built for customers who want premium-level perks — lounge access, travel offers, low interest rates, low forex mark-up — without paying high annual fees. This card combines affordability, high credit limits, and lifestyle benefits, making it one of the most rewarding premium cards in India.

Let’s break down what makes this card shine, along with pros, cons, and a real-life example.

Key Features of IDFC FIRST Wealth Credit Card

| Feature | Details |

|---|---|

| Annual Fee | Lifetime Free |

| Interest Rate | As low as 0.75% per month (9% p.a.) |

| Lounge Access | 4 Domestic & 4 International Airport Lounge Visits/Year |

| Forex Markup | Only 1.5%, much lower than usual 3.5% |

| Golf Access | Complimentary Golf Rounds & Lessons |

| Accident Insurance | ₹10 lakh cover |

| Cashback/Rewards | 6X–10X rewards on online/in-app purchases; 3X elsewhere |

Who Should Get This Card?

This card is ideal for:

Working professionals or freelancers with steady online spending

International travelers who want lounge access and low forex markup

Customers seeking a lifetime free premium credit card

People who want lower interest rates and great EMI options

Meet Priya – A Freelancer Who Travels & Spends Smart

Priya is a 30-year-old content consultant who travels frequently for work and uses her credit card to manage all her monthly payments — from gadgets to groceries to travel bookings. She was looking for a zero-fee card that still offered premium perks.

Here’s how she benefits every month with the IDFC FIRST Wealth Credit Card:

| Category | Monthly Spend | Reward/Benefit | Value |

|---|---|---|---|

| Online purchases (above 20k) | ₹30,000 | 10X reward points | ₹500 worth |

| Travel & International spends | ₹10,000 | 20-50X point + Low forex markup | ₹400 saved |

| Entertainment & lifestyle | ₹10,000 | Movies | ₹200 saved |

| Fuel & utility bills | ₹20,000 | 1-3X reward points | ₹100 saved |

| Monthly Value Gained | – | – | ₹1,200+ |

Bonus: She got ₹500 as a welcome gift and enjoys Golf and Lounge Privileges

Pros of IDFC FIRST Wealth Credit Card

- Lifetime free card with premium benefits

- Strong travel and lifestyle privileges

- Low interest rates, EMIs & credit limit options

- Great for salaried users, freelancers, and consultants

Possible Limitations

- Not designed for heavy cashback lovers

- Some rewards are better used through IDFC app/portal

- No accelerated rewards on grocery/fuel

If you’re someone who wants value across travel, shopping, and lifestyle — and don’t want to pay high annual fees — this card might be the most balanced premium option out there. Available via PickMyWork, you can get this card delivered quickly and start enjoying benefits from Day one.

How to Apply via PickMyWork

- Sign up on PickMyWork

- Choose ‘IDFC First Wealth Credit Card’ in the app

- Apply or refer others

- Earn commission on each approved application

Apply now or start referring on PickMyWork App – Download Link – Android, iPhone

FAQs

Is IDFC FIRST Wealth Credit Card really lifetime free?

Yes, there are no joining or annual fees — ever.

How much can I save using this card?

Depending on your spending, savings from cashback, lounge access, forex, and offers can total ₹10,000–₹15,000/year.

Does this card offer airport lounge access internationally?

Yes, you get 4 international + 4 domestic lounge visits per year.

How can I apply for this card via PickMyWork?

Simply sign up here and go to the credit cards section to check availability and eligibility.

Is it a good card for salaried individuals?

Absolutely! It works well for both salaried users and freelancers with consistent digital spends.

What are the other Credit Cards options for me?

Check out all the credit cards here – Choose your credit card & fill your digital credit card application right away