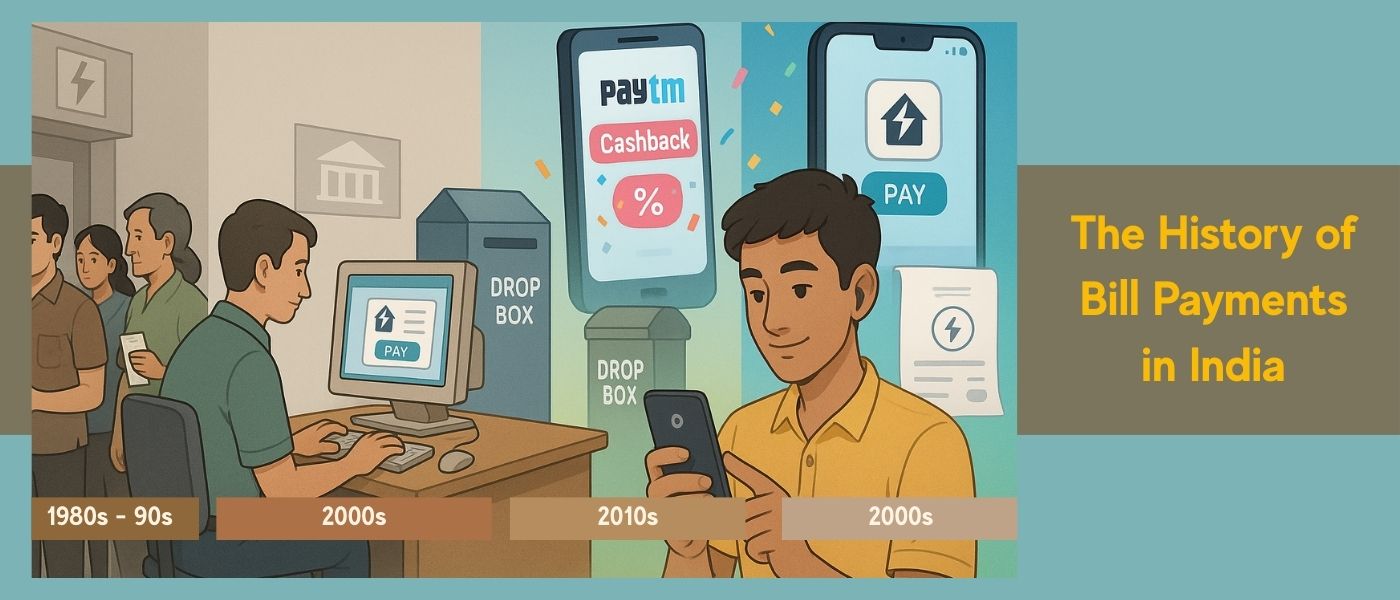

If you grew up in India before the 2000s, you probably remember what paying a bill used to mean: carrying cash, standing in long queues at electricity offices or telephone exchanges, and hoping the counter didn’t close before your turn came. Missing a due date could mean disconnection, and a “bill payment day” was almost like a dreaded ritual in every household. Imagine taking half a day off to make bill payments or running during lunch breaks to drop cheques. Some have lived it and some will thankfully, never know it!

Fast forward to today, and paying a bill takes less than a minute on your smartphone — often with rewards or cashback. What once felt like a monthly burden has now turned into a seamless experience, and even an opportunity to save and earn.

The journey from cash counters to digital apps is a story of innovation, competition, and changing consumer habits. From the early days of BillDesk to the cashback wars of Paytm and Freecharge, and finally the UPI and BBPS revolution, bill payments in India have transformed beyond recognition.

And now, with apps, this journey has taken yet another turn: bill payments are not just about convenience, they’re also about cashback and earnings. Lets look at this history together to know better:

The Queue Era (1980s–1990s)

For decades, paying bills in India meant standing in long lines at electricity boards, municipal offices, or telephone exchanges. Payments were in cash, offices shut by 4 PM, and missing a due date often meant disconnection. But thankfully nothing was instant – neither the payment nor the disconnection.

- Consumers had no flexibility.

- Banks only acted as collection windows, not active players.

This was the era of inconvenience and inefficiency.

The Bank Partnership Era (late 1990s–2005)

As liberalization expanded, banks started playing a bigger role. Tie-ups between SBI, ICICI, and HDFC with utilities allowed payments at branches or via drop boxes.

- Still offline, but queues shifted from government counters to bank counters.

- Convenience improved slightly, but cash and cheques dominated.

The BillDesk & Early Aggregators Era (2000s)

BillDesk (founded in 2000) was India’s first serious bill-payment aggregator. Suddenly, customers could pay multiple bills online using one platform.

- BillDesk partnered with banks and utilities to power their online portals.

- It was revolutionary for urban customers, but adoption was low due to low internet penetration.

Competitors like TechProcess also entered, but BillDesk became the backbone for banks’ “Pay Bills” tabs.

The Wallet & Cashback Era (2010–2016)

This was the golden age of Freecharge, Paytm, and MobiKwik.

- They gamified bill payments with instant cashback (Freecharge coupons, Paytm wallet cash, MobiKwik SuperCash).

- Competition was brutal — users often switched apps depending on who offered the best reward that week.

- Telecom bills and DTH recharges became the big drivers of adoption.

Cashback wasn’t just a perk — it was the engine that got Indians comfortable with paying digitally.

The UPI + BBPS Era (2016–present)

With the launch of UPI (2016) and Bharat Bill Payment System (BBPS), India finally had a unified, interoperable bill-pay backbone.

- Any bill, from electricity to school fees, could be paid digitally.

- PhonePe, Google Pay, Amazon Pay leveraged UPI to pull customers from wallets.

- Banks and fintechs integrated BBPS for standardization and receipts.

Competition shifted from cashback wars to ecosystem lock-in. Instead of 100% cashback, players offered rewards, points, and loyalty benefits to retain customers.

The Present Day: Instant & Everywhere

Today, paying bills is:

- Instant – a few taps on UPI apps.

- Rewarding – via credit card points, UPI scratch cards, and offers.

- Universal – even small-town users can pay digitally, thanks to BBPS.

Bill payments have gone from a monthly headache to an everyday habit loop.

Why does this history matter?

This history matters because digital bill payments have not only changed convenience — they’ve created new income opportunities. Platforms like PickMyWork empower gig workers to earn by helping others adopt UPI, link billers, or choose the right payment method (like cashback-friendly credit cards).

What began as a monthly liability (standing in line to pay bills) has now become an earning opportunity in India’s digital economy.

With the PickMyWork app, users don’t just enjoy easy digital bill payment options — they can also:

- Access cashback offers linked to bill payments and recharges

- Discover partner deals from banks, wallets, and fintechs

- Use the same app to pick up gig tasks and earn on the side

So while India’s bill payments story has been about convenience and rewards, PickMyWork makes sure you can also turn that ecosystem into an earning opportunity.

FAQs on Bill Payments in India

Q1. What was the first digital bill payment platform in India?

The first major aggregator was BillDesk, founded in 2000. It allowed users to pay multiple bills online through one platform and later powered the bill payment tabs of many banks.

Q2. Why were cashback offers so important in India’s bill payment history?

Cashback, introduced aggressively by apps like Freecharge, Paytm, and MobiKwik during the 2010–2016 period, was the biggest driver of adoption. For many first-time users, getting ₹20–₹50 back on a recharge or bill created trust and excitement around digital payments.

Q3. What is BBPS and why is it important?

The Bharat Bill Payment System (BBPS), launched by NPCI, is a centralized system that standardizes recurring bill payments like electricity, water, DTH, and school fees. It ensures instant confirmation, reliability, and dispute redressal.

Q4. How did UPI change bill payments in India?

Before UPI, users had to depend on wallets or net banking. With UPI (Unified Payments Interface), payments became instant, interoperable, and free — and bill payments were integrated into the same apps people already used daily, like PhonePe, Google Pay, and Paytm.

Q5. Who are the main players in bill payments today?

Today, UPI-based apps like PhonePe, Google Pay, Paytm, as well as Amazon Pay, BharatPe, and traditional banks via BBPS dominate the ecosystem. Each competes through rewards, credit card integrations, and loyalty programs.

Q6. How does PickMyWork fit into bill payments?

PickMyWork not only offers an easy way to pay bills digitally but also provides cashback benefits to users. Additionally, it allows gig workers to earn by helping others adopt digital payments — making bill payments both rewarding and income-generating.