The HDFC Pixel Play Credit Card is a fresh addition to the Indian credit card landscape — especially appealing to digitally savvy users. With no joining fee, configurable cashback, and full control through the PayZapp app, it’s designed for those who prefer personalized, hassle-free rewards.

At PickMyWork, you’ll not only find this card valuable but also earn when you recommend it to others.

Key Features – HDFC Pixel Credit Card

Lifetime Free – No joining or annual fee ever

5% Cashback on two selected merchant categories (e.g., dining, groceries, entertainment), capped at ₹500 per category monthly

- Dining & Entertainment Category – BookMyShow & Zomato

- Travel Category – MakeMyTrip & Uber

- Grocery Category – Blinkit & Reliance Smart Bazaar

- Electronics Category – Croma & Reliance Digital

- Fashion Category – Nykaa & Myntra

3% Cashback on one chosen e-commerce merchant (Amazon, Flipkart, or PayZapp), capped at ₹500/month

1% Cashback (unlimited) on all other spends, including UPI (RuPay variant), capped at ₹500/month

Fuel surcharge waiver: 1% waiver (up to ₹250/month) on fuel transactions

Digital-only control: Manage the card entirely via the PayZapp app — choose billing date, set controls, and block or unblock instantly.

Pros & Highlights

Completely free forever: Ideal for beginners building credit.

Tailored cashback: Choose 2 categories for 5% and 1 e-commerce partner for 3%.

Digital command center: All in-app controls, including setting up UPI with your RuPay variant.

Fuel waiver: Automatic savings every month on essential transfers.

Points to Consider about the HDFC Pixel Credit Card

- Monthly caps mean max cashback is ₹1,500 (2 × ₹500 + ₹500 + ₹500).

- No airport lounge access — best suited for everyday use.

- Rewards are credited as Pixel CashPoints, which must be redeemed via PayZapp — not cashback to bank account.

- Offers & caps may change; always refer to the latest terms.

Is It Worth Applying?

PickMyWork meter says Yes, if:

- You seek a free credit card with flexible rewards.

- You prefer customizable cashback instead of fixed categories.

- You want full control through an app, without needing physical branches.

Plus, referrals via PickMyWork mean you benefit if your friends apply successfully.

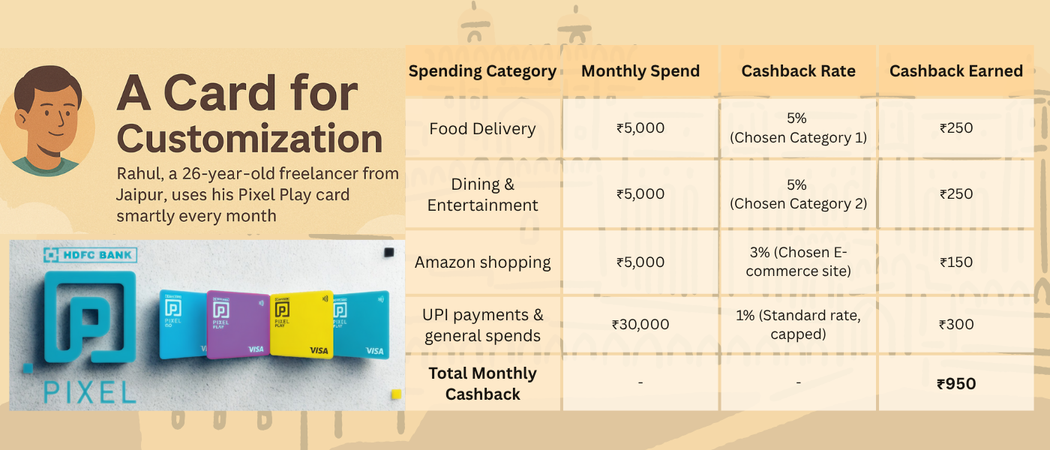

A Card Made for People Who Like to Customize — Like Rahul

Unlike most cards that lock you into predefined cashback categories, the HDFC Pixel Play Credit Card is designed for people who want flexibility and control. Whether you’re a student, a freelancer, or a side hustler — this card lets you choose where you earn the most.

Take Rahul, a 26-year-old freelancer from Jaipur. He’s tired of credit cards that reward him for things he rarely buys. What he loves about Pixel Play is the freedom to pick his cashback categories and earn maximum value on what he actually spends on.

Here’s how Rahul uses the Pixel Play card smartly every month:

| Spending Category | Monthly Spend | Cashback Rate | Cashback Earned |

|---|---|---|---|

| Food delivery | ₹5,000 | 5% (Chosen Category 1) | ₹250 |

| Dining & Entertainment | ₹5,000 | 5% (Chosen Category 2) | ₹250 |

| Amazon shopping | ₹5,000 | 3% (Chosen E-commerce site) | ₹150 |

| UPI payments & general spends | ₹30,000 | 1% (Standard rate, capped) | ₹300 (max cap) |

| Fuel transactions | ₹5,000 | 1% surcharge waiver | ₹50 |

| Total Monthly Cashback | — | — | ₹1,000 |

Rahul tweaks his categories every few months based on what he’s planning to spend on — groceries, electronics, dining, or travel. The result? – More control. More cashback. Zero annual fees.

And if Rahul refers the card to his friends via PickMyWork, he earns even more. It’s a win-win for anyone who wants a smarter way to use credit cards.

How to Apply via PickMyWork

- Sign up on PickMyWork

- Choose ‘HDFC Pixel Play Credit Card’ in the app

- Apply for yourself or refer others

- Earn commission on each approved application

Apply now or start referring on PickMyWork App – Download Link – Android, iPhone

FAQs – HDFC Pixel Play Credit Card

Q1: Is it truly free forever?

Yes, there’s no joining or annual fee.

Q2: How do I customize my cashback categories?

Choose 2 merchant packs for 5% and one e-commerce partner for 3% via PayZapp.

Q3: What’s the total cashback limit each month?

Up to ₹1,500 – two 5% categories (₹500 each), one 3%, and 1% on others up to ₹500.

Q4: Is there a cap on UPI cashback?

Yes, 1% cashback (RuPay/UPI) capped at ₹500/month.

Q5: Do I need a physical Visa card for non-UPI payments?

Your RuPay Pixel Play works digitally, and HDFC issues a physical Visa version if requested

Q6: How can I refer the card via PickMyWork?

Log into PickMyWork, select the HDFC Pixel offer, and share your referral link. You earn when the application completes successfully.

Q7. What are the other Credit Cards options for me?

Check out all the credit cards here – Choose your credit card & fill your digital credit card application right away