Looking for a travel-friendly credit card that doesn’t try to be flashy but actually delivers? The Scapia Federal Bank Credit Card is exactly that — lifetime free, zero forex surcharge, and genuinely useful travel rewards.

If your spending spans flight tickets, overseas orders, or late-night hotel stays, this underdog deserves a spot in your wallet.

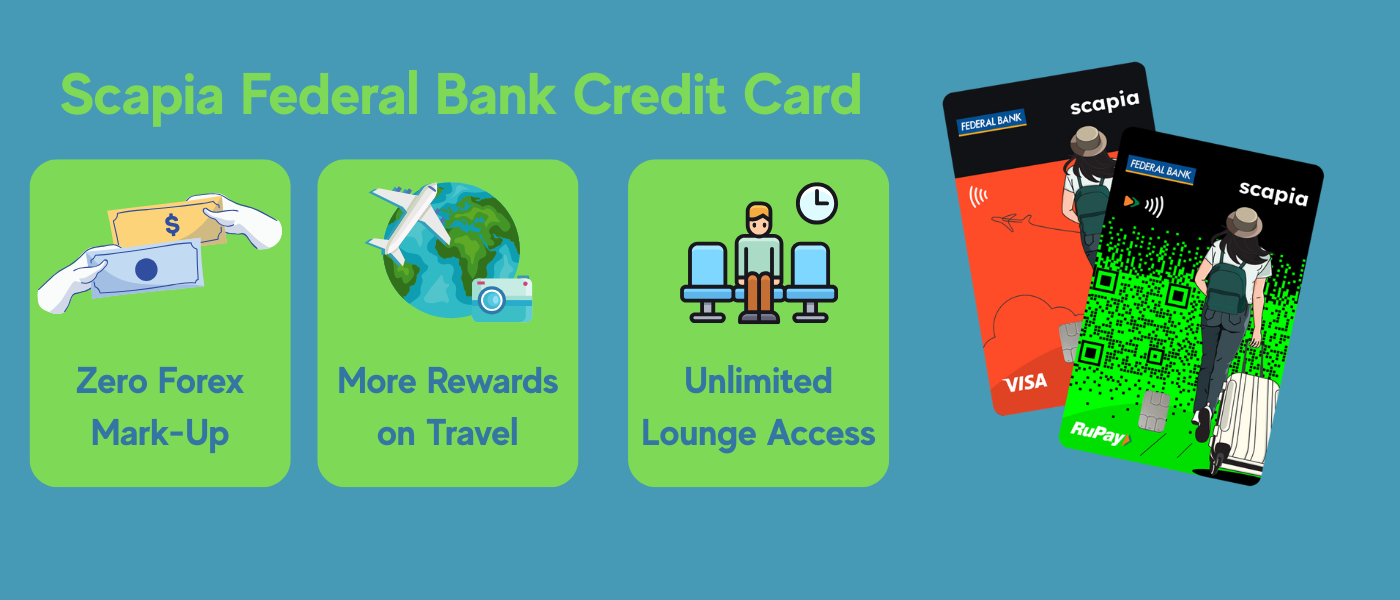

Quick Highlights – Scapia Federal Bank Credit Card

Lifetime free — no joining fee, no annual fee

Zero forex markup — perfect for international travel or online foreign purchases

Scapia Coins: Earn 10% (2% effective) rewards on most spends and 20% (4% value) on travel bookings through Scapia app

Unlimited domestic lounges — unlock with ₹10,000 monthly spend

1 Scapia Coin = ₹0.20 when redeemed for travel deals

Scapia Credit Card – Who It’s For

Ideal for:

- Frequent travelers (domestic and international)

- International Family Vacationers

- Remote workers placing international orders

- Students studying abroad

- People who want simple, effective travel perks

Meet Rahul — A Travel-Heavy User

Rahul takes 5–6 international flights a year for work, plans 1 international family vacation, books hotels, and shops gifts for family when he travels for work. Here’s his typical and annual spend:

| Category | Avg Monthly Spend | Coin % (Scapia) | ₹ Equivalent (/month) | ₹ Equivalent (annual) |

|---|---|---|---|---|

| Flights & Hotels via Scapia | ₹50,000 | 20% (4% effective) | ₹2,000 | ₹24,000 |

| Other spends (offline, UPI, groceries) | ₹30,000 | 10% (2%) | ₹600 | ₹7,200 |

| Total Rewards | — | — | ₹2,600 | ₹31,200 |

| Forex Savings | ₹500,000 abroad annually | — | Avoids ₹17,500 markup (at 3.5%) | ₹17,500 saved |

| Total Benefit/Year | — | — | — | ₹48,700 |

Even against premium travel cards with fees, Rahul comes out thousands ahead each year — with no fees, no surprises, and simple rewards.

Pros

- Zero forex markup — no hidden fees abroad

- Effective 2%–4% travel rewards — ahead of most LTF cards

- Unlimited domestic lounge access — unlocked easily

- Travel redemption built into the app

- Instant virtual + UPI-enabled RuPay card

Cons

- Rewards limited to Scapia-travel redemptions

- No rewards for rent, gift cards, wallet reloads, or utilities

- RuPay acceptance may vary internationally

- Redeeming coins only through Scapia travel platform

- Utility, Telecom and cable spends beyond 20,000/ statement month will not accrue any rewards

The Scapia Federal Bank Credit Card is a minimalist yet powerful tool for travelers and globetrotters. If your life involves flights, foreign marketplaces, and airport visits, this is the underdog card with real edge.

How to Apply via PickMyWork

- Sign up on PickMyWork

- Choose ‘Scapia – Federal Bank’ in the credit card section on the app

- Apply or refer others

- Earn commission on each approved application

Apply now or start referring on PickMyWork App – Download Link – Android, iPhone

FAQs – Scapia Federal Bank Credit Card

Is it truly free?

Yes, there are zero joining or annual fees

How valuable are Scapia Coins?

You earn 10% as coins (worth 2%) on most spends, 20% (4%) on travel bookings via Scapia — with no earning caps

Where can the coins be used?

Flights, hotels, bus, and train bookings through the Scapia app — redeemed at ₹0.20/coin

Is there 0% forex fee on all international transactions?

Yes — no surcharge added to foreign transactions.

Any other card you suggest for low or no forex markup?

Yes — IDFC First Wealth Credit Card has zero joining fees and low forex markup of 1.5%. Apply here. Read more details here.

How do I get lounge access?

Spend ₹10,000+ in a billing cycle to unlock unlimited domestic lounge access for the next month

Really unlimited lounges?

Yes — there’s no cap, as long as the spend criteria is met.

What are the other Credit Cards options for me?

Check out all the credit cards here – Choose your credit card & fill your digital credit card application right away