Psst! Your credit card utilization is always under the watchful eyes of banks. They calculate your credit score using the credit utilisation ratio—it’s like a fashion statement for your finances. Divide your total credit expenditure by available credit, strike a low percentage, and watch those financial institutions swoon. Stay tuned as we spill the beans on how it’s all calculated and why keeping it low is oh-so-important.

Demystifying Revolving Credit:

Think of revolving credit like a flexible friend. It’s the credit you get from your credit cards, with no fixed repayment date. Each month, you have two choices: pay it all back or pay some and borrow the rest. Your credit limit is the maximum amount you can borrow. Just remember, the more you use, the higher your credit utilization ratio gets. So, keep it in check to keep your financial life balanced.

The High-key Wonders of Low-key Credit Card Utilization:

Picture this: you possess a shiny credit card with a generous monthly limit of INR 1,00,000. Ah, the possibilities! But wait, did you know that using only INR 50,000 of that credit signifies you’re a financial wizard? Yes, my friend, you’re rockin’ that 50% utilization rate like a boss.

You’re a Master of Your Finances: By keeping your credit utilization low, you’re sending a message loud and clear: you’re in control. It shows that you’re not relying heavily on credit, but rather managing your expenses wisely. You’ve got your financial game face on, and the banks appreciate that.

The real superhero in this story: your credit score. It’s like the cape-wearing guardian that determines your eligibility for future loans and financial opportunities.

Maintaining low debts on your credit cards is the key to leveling up your credit score. As you keep that credit utilization rate low, your score gradually climbs the ladder to greatness. It’s like unlocking achievements in a video game, but with real-life rewards.

Imagine striding into a bank, your credit score shining like a sword of financial destiny. With a low credit utilization rate, you’ve proven your trustworthiness and fiscal prowess. Lenders will see you as a worthy candidate for loans, mortgages, and other financial blessings. Who needs a fairy godmother when you’ve got low credit utilization?

https://www.pickmywork.com/credit-card/

How is Credit Card Utilization Rate Calculated?

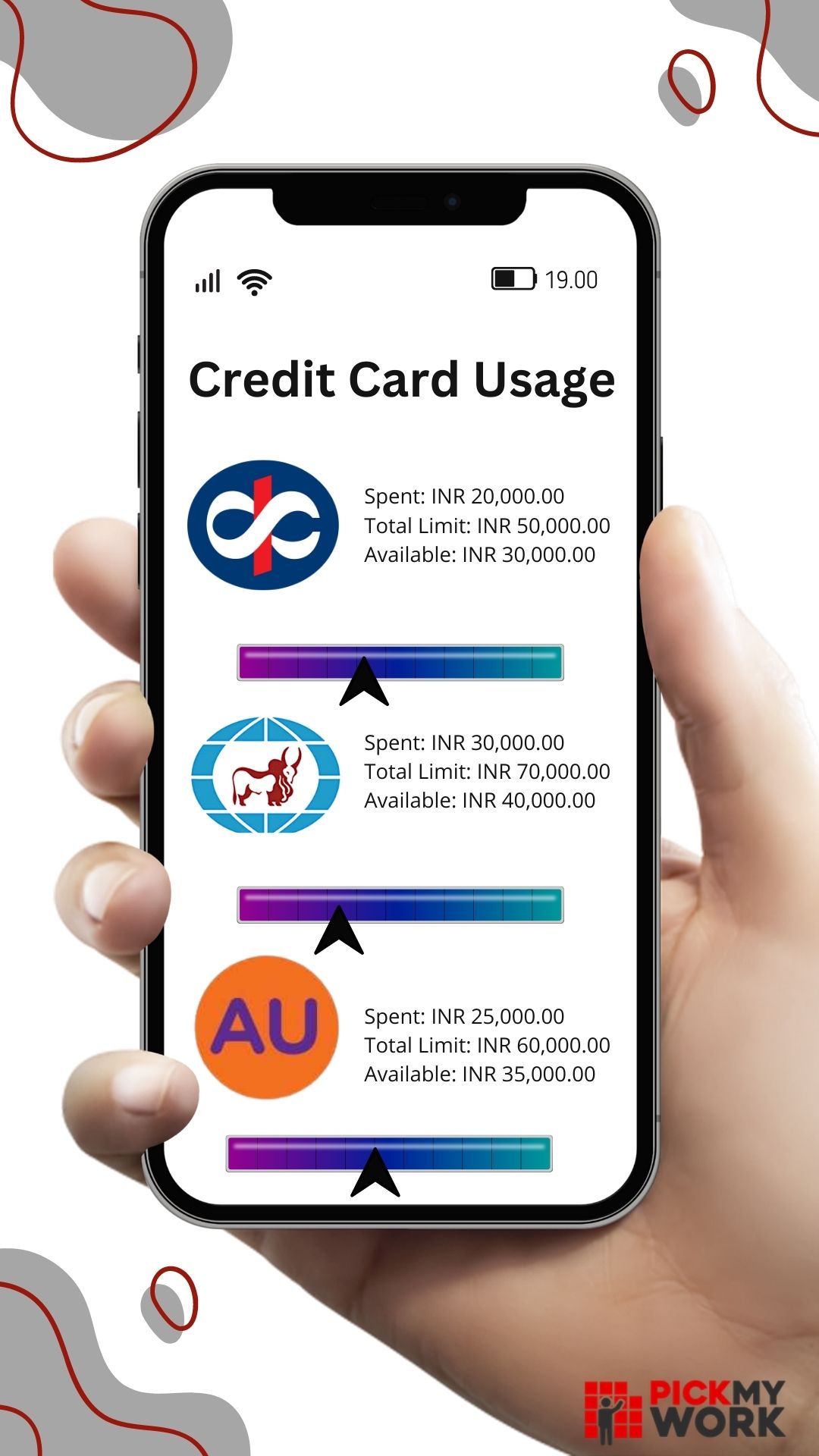

The calculation of the credit utilization rate starts with the sum of all existing credit sources. For instance, assume Person A has three accounts with the following balances:

The first step for calculating the credit utilization ratio is adding up the total revolving credit available. In this case, the amount comes up to ₹1,80,000. Next is the total debt incurred from all these credit sources, which amounts to ₹75,000.

Credit card utilization ratio = The total credit used/Total revolving credit available.

Using this formula, the total credit utilization ratio for Person A is approximately 42%. However, it is recommended to maintain a rate of 30% or lower every month to increase your credit score.

Summing Up:

Your credit card utilization ratio summarizes your spending habits to credit lending organizations. It is vital to maintain a respectable score through timely payments of credit card payments and avoiding the build-up of surplus debt.

Click here to know more about really cool and convenient credit cards on PickMyWork.