Selling credit cards can seem like a tough task, but with the right approach, you can achieve incredible results. Imagine turning cold prospects into loyal customers and doubling your income effortlessly. Sounds impossible? Not at all! Here’s your ultimate guide to sell credit cards like a pro and achieving 10x results.

1. Understand the Market to Sell Credit Cards

Did you know that over 60% of Indians still prefer using cash for their transactions? Yet, the credit card market is growing at a rapid pace, with more than 50 million active credit cards in India.

To get higher conversions, let’s start with understanding the market. Who are your potential customers? What are their needs and preferences? For instance, millennials (age group 28-43 years) might prefer cards with travel rewards, while baby boomers might look for low interest rates.

2. Know Your Product

According to a study by TransUnion CIBIL, customers are 40% more likely to purchase a credit card if the salesperson is knowledgeable about the product.

Get to know the credit cards you’re selling inside out.

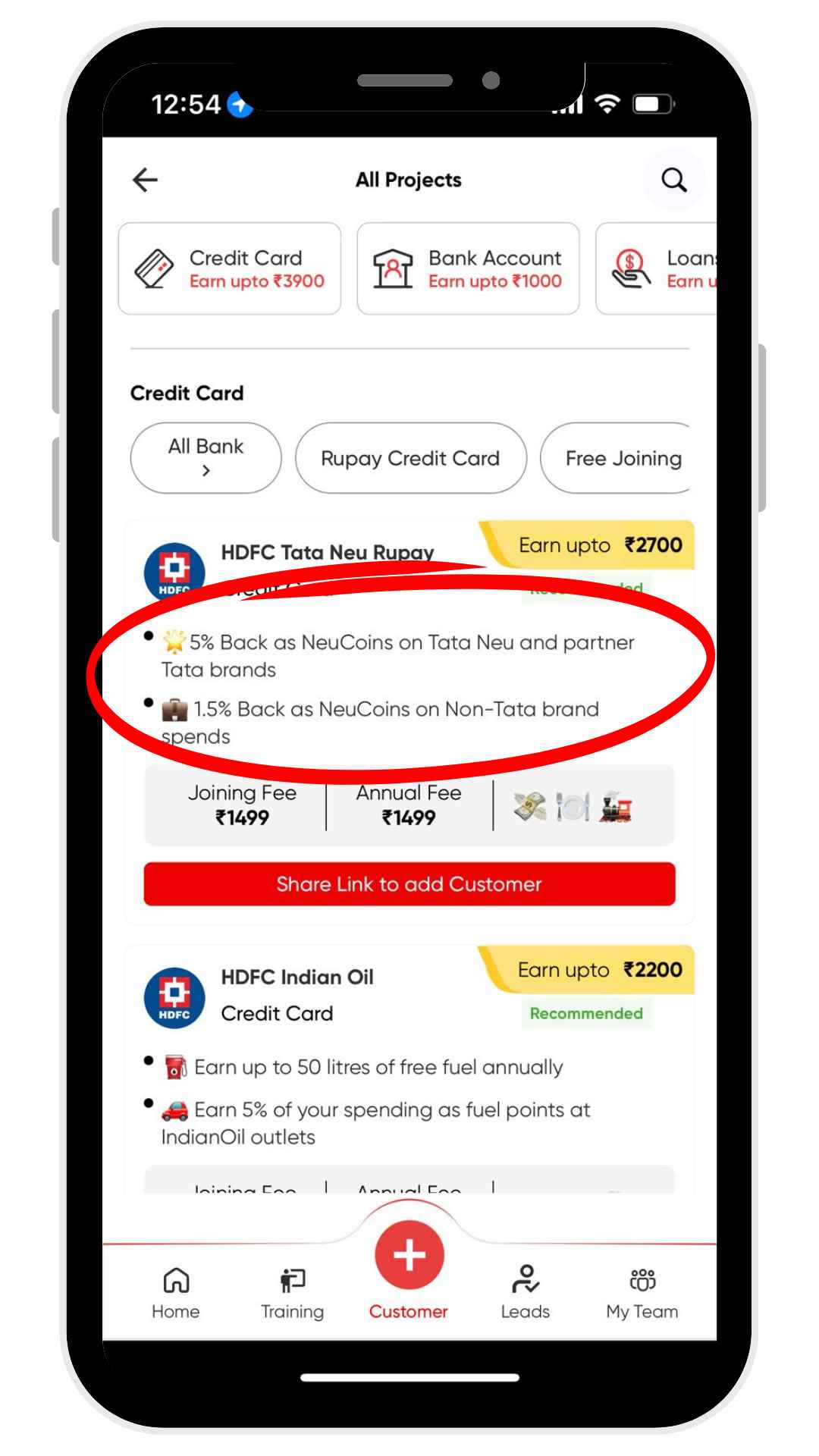

Rahul, a PickMyWork sales partner, who sells credit cards, always refers to the PickMyWork App for a cheat sheet of the latest offers and benefits of various credit cards. This allows him to quickly reference and highlight the most relevant features to his customers.

3. Master the Art of Communication

The attention span in today’s digital age is just 7 seconds. Your customer will decide in 7 seconds to go ahead with you or not.

First impressions matter. Start your conversation with a warm greeting and a confident introduction. Use open-ended questions to understand the customer’s needs. For example, ask, “What kind of spends you usually do daily?”

4. Use Real-Life Examples to Sell Credit Cards

Storytelling can boost your sales by up to 20%! People relate more to stories than to plain facts and figures.

Share success stories and real-life examples to build credibility.

For instance, mention different banks and how a customer saved thousands using a specific credit card’s rewards program.

Bank Credit Card | Reward Program | Real-Life Savings Example |

|---|---|---|

HDFC Regalia Credit Card | 4 Reward Points for every ₹150 spent | A user accumulated 50,000 reward points over a year, which they redeemed for a free flight ticket worth ₹15,000, saving on their travel expenses. |

ICICI Bank Coral Credit Card | 2 Reward Points for every ₹100 spent on all purchases | By using the card for everyday expenses, a user earned 10,000 reward points in a year, which they redeemed for movie tickets worth ₹2,500. |

Axis Bank Neo Credit Card | 10% cashback on online purchases from partner websites | A user saved ₹3,000 over a year by using the card for shopping on partner websites like Amazon and Flipkart, benefiting from the cashback offers. |

American Express Membership Rewards Credit Card | 1,000 Membership Reward Points for 4 transactions of ₹1,000+ in a month | A cardholder collected 12,000 reward points annually by making consistent transactions, which they used for a hotel stay worth ₹8,000, reducing their vacation costs. |

Citi PremierMiles Credit Card | 10 Miles for every ₹100 spent on airline transactions | A frequent traveller earned 50,000 miles in a year, which they redeemed for a business class upgrade on an international flight, saving ₹25,000 on their airfare. |

Standard Chartered Super Value Titanium Credit Card | 5% cashback on fuel purchases, 1 Reward Point per ₹150 spent | A user saved ₹2,400 annually on fuel expenses through cashback and accumulated reward points worth ₹1,500, which they used for gift vouchers. |

Kotak Mahindra Royale Signature Credit Card | 4x Reward Points on dining, travel, and international spending | By using the card for travel and dining, a customer earned 25,000 reward points, which they redeemed for a holiday package, saving ₹10,000 on their trip. |

IndusInd Bank Platinum Aura Edge Credit Card | 4 Reward Points per ₹100 spent on select categories | A user focused on spending in the reward categories, earning 15,000 reward points, which they used for electronic gadgets, saving ₹7,500 on their purchase. |

Yes First Preferred Credit Card | 8 Reward Points per ₹200 spent on travel and dining | A cardholder earned 30,000 reward points through travel and dining expenses, which they converted into travel vouchers worth ₹12,000, reducing their holiday costs. |

5. Leverage Technology

70% of salespeople who use software report higher productivity.

Using apps like PickMyWork can help you recommend the right card and simplify the application process for your customers.

6. Follow-Up Effectively

Persistence is key. Schedule follow-ups to address any questions or concerns your prospects might have. A brief follow-up message like, “Hello [Customer], I wanted to check if you have any further questions about the XYZ Credit Card,” or “XYZ is running a great offer for this month, might be the best time to get it” can be very effective.

Steps for Effective Follow-Up:

- Prompt: Reach out within one to two days following the initial interaction.

- Personalized: Refer to your previous conversation to show you remember their needs.

- Value-Added: Provide additional information or benefits that might interest them.

By following these steps and incorporating quirky facts and real-life examples, you’ll not only meet but also exceed your sales targets. Remember, persistence and personalization are your best friends in this journey.

Ready to 10x your results? Download the PickMyWork app today and start your journey to becoming a top credit card sales professional!

Happy selling!