Are you dreaming of owning a home in Andhra Pradesh but find the cost of housing daunting? The NTR Housing Scheme could be the key to unlocking the door to your own home. This government initiative, aimed at providing affordable housing to the state’s underprivileged urban and rural populations, is a beacon of hope for many. In this blog, we delve into the details of the NTR Housing Scheme, offering you a roadmap to understanding and availing of this life-changing opportunity.

What is the NTR Housing Scheme?

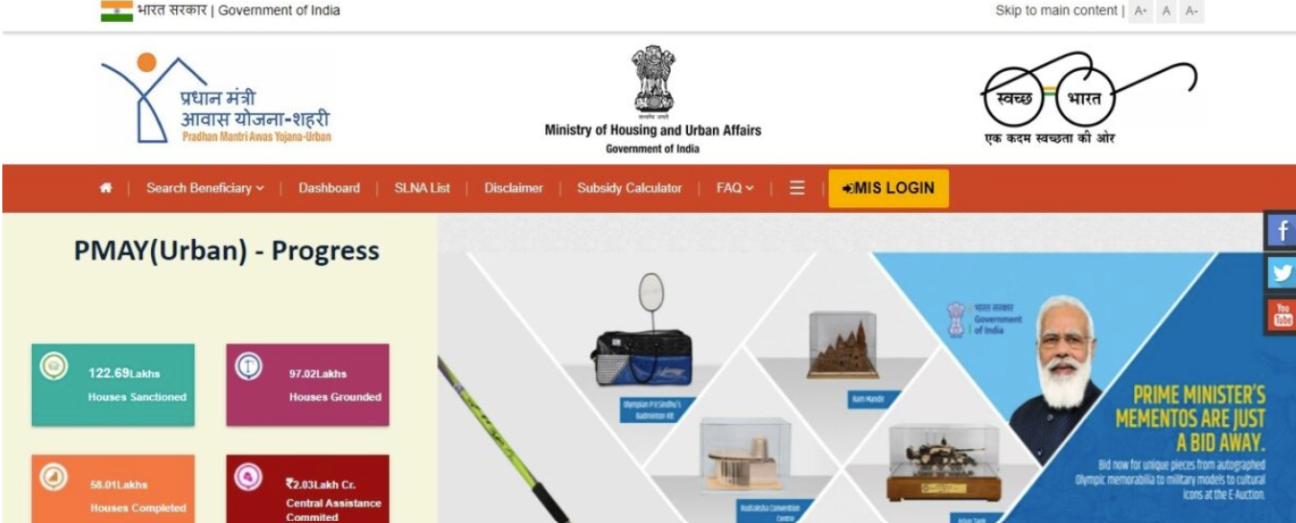

Launched in 2016, the NTR Housing Scheme is part of the broader Pradhan Mantri Awas Yojana (PMAY) and reflects the Central Government’s vision of “housing for all”. With a budget of ₹16,000 crores, the scheme’s ambitious goal is to develop 10 lakh houses in Andhra Pradesh, catering specifically to the housing needs of the state’s rural and urban underprivileged sections.

The scheme is split into two distinct parts: PMAY NTR Gramin, targeting rural residents, and PMAY NTR Urban Beneficiary Led Construction (BLC), aimed at urban dwellers. This bifurcation ensures that the unique housing requirements of both demographics are met effectively.

The primary goals of the NTR Housing Scheme are twofold:

- To Provide Affordable Permanent Homes: The scheme’s main aim is to offer “pucca” houses to homeless people across urban and rural settings, ensuring security and dignity for all.

- To Facilitate Reconstruction: It also focuses on offering affordable reconstruction opportunities for existing houses that are in disrepair, improving living conditions for current homeowners.

Eligibility Criteria

- Residency: Applicants must be residents of Andhra Pradesh.

- Economic Status: Individuals must have a Below Poverty Line (BPL) or White Ration Card.

- Ownership: Applicants should not own any land or houses under other government housing schemes.

Application Process Simplified:

- Visit the PMAY Website: Sign up or log in with your credentials. (https://pmaymis.gov.in/)

- Choose the Right Category: Select ‘For Slum Dwellers’ or ‘Benefits under 3 other components’, depending on your eligibility.

- Fill in the Form: Provide your Aadhaar details and complete the application form.

Once submitted, the authorities will review your application, and if accepted, you will be notified via email and traditional mail.

Documentation Required

- Identity proof (Aadhaar card, voter ID, driving licence, etc.)

- Income proof and details of family income

- Residential address proof

- Details of the existing house (if any)

- Bank details

- Caste, religion certificates, and BPL status documents (if applicable)

- Subsidies and Benefits

The NTR Housing Scheme offers substantial subsidies to make housing more affordable:

- Rural Beneficiaries: Receive a subsidy of ₹1.5 lakh.

- Urban Beneficiaries: Can avail of a ₹2.5 lakh subsidy.

- Additional Support for SC/ST: An extra subsidy of ₹50,000 is provided.

Under the scheme, the cost of homes is tailored to be affordable, with prices ranging based on size:

- 300 sq. ft. homes are priced at ₹5.62 lakh.

- 365 sq. ft. homes at ₹6.74 lakh.

- 430 sq. ft. homes stand at ₹7.71 lakh.

Checking Your Beneficiary Status: To find out if you’ve been selected

- Visit the official Andhra Pradesh State Housing Corporation website.

- Click on ‘Gruha Pravesh Mahotsvam Ben List’.

- Follow the prompts to access the list of beneficiaries (https://rhreporting.nic.in/netiay/newreport.aspx)

The NTR Housing Scheme is a significant step towards making affordable housing accessible to everyone in Andhra Pradesh. With clear eligibility criteria, an easy application process, and substantial subsidies, the dream of owning a home is now within reach for the state’s underprivileged populations. If you meet the eligibility requirements, don’t hesitate to apply and take the first step towards owning your own home.

Remember, a home is not just a shelter; it’s a foundation for your future. The NTR Housing Scheme is here to help you build that foundation, you can start with PickMyWork to build credit and get loans.