India’s digital payment revolution has dramatically transformed how people pay for goods and services. With platforms like UPI (Unified Payments Interface) surging in popularity, many believed that cash in India would soon become obsolete. However, the CMS India Cash Vibrancy Report 2023 presents a different narrative. Despite the growth of digital payments, cash in India remains significant, underscoring its vital role in India’s economy.

The Current State of Cash in India

- Increase in ATM Withdrawals: The average monthly value of ATM withdrawals increased from INR 1.35 crore in FY23 to INR 1.43 crore in FY24, marking a 5.51% rise. This steady demand for cash persists despite the surge in digital transactions.

- Urban vs. Rural Divide: Urban areas, particularly metro cities, saw a 10.37% increase in cash withdrawals from FY23 to FY24, while semi-urban and rural areas experienced smaller increases of 3.94% and 3.73%, respectively. This highlights a digital divide, with urban populations more comfortable using a mix of cash and digital payments.

- From FY 2012 to FY 2016, both the GDP growth rate and currency in circulation/GDP ratio were relatively stable.

- FY 2017 saw a sharp decline in the currency in circulation/GDP ratio due to demonetisation.

- Post-demonetization, the ratios gradually increased, with significant spikes during economic downturns, such as the COVID-19 pandemic in FY 2021.

Real-Life Examples of Cash in India

- Street Vendors and Local Markets: In many parts of India, especially urban areas, street vendors and local market sellers still prefer cash transactions. For example, in Delhi’s Chandni Chowk market, vendors often request cash payments due to the high transaction fees associated with digital payments and the immediate liquidity cash provides.

- Public Transport: In cities like Mumbai, cash remains the quickest and easiest way to buy tickets for local trains and buses. While digital options are available, many commuters find it more convenient to use cash for these small, everyday transactions.

- Rural Areas: In rural areas, where digital literacy and internet connectivity are still challenges, cash remains the primary mode of transaction. Farmers selling their produce at local markets or buying supplies often rely on cash, as digital payment infrastructure is not always available.

- Cash Replenishment Per ATM (₹ Cr): Look at the table below for cash replenishment data (₹ Cr) state-wise, Jammu & Kashmir was the only state that saw a decline in ATM cash replenishments from ₹1.13 Cr in FY 2022 to ₹1.02 Cr in FY 2023.

Cash Replenishment Per ATM (₹ Cr) State-wise

| State/UT | FY 2022 | FY 2023 |

| Andhra Pradesh | 1.4 | 1.57 |

| Assam | 0.96 | 1.18 |

| Bihar | 1.01 | 1.18 |

| Chhattisgarh | 1.62 | 1.58 |

| Delhi | 1.3 | 1.73 |

| Goa | 0.88 | 1.08 |

| Gujarat | 1.3 | 1.46 |

| Haryana | 1.16 | 1.28 |

| Himachal Pradesh | 1.06 | 1.3 |

| Jammu & Kashmir | 1.13 | 1.02 |

| Jharkhand | 0.98 | 1.13 |

| Karnataka | 1.46 | 1.73 |

| Kerala | 1.13 | 1.3 |

| Madhya Pradesh | 1.35 | 1.57 |

| Maharashtra | 1.31 | 1.48 |

| Odisha | 1.06 | 1.19 |

| Punjab | 1.3 | 1.51 |

| Rajasthan | 1.17 | 1.35 |

| Tamil Nadu | 1.2 | 1.39 |

| Tripura | 1.08 | 1.21 |

| Uttarakhand | 1.03 | 1.14 |

| Uttar Pradesh | 1.03 | 1.18 |

| West Bengal | 1.18 | 1.39 |

Factors Contributing to Cash in India

- Limited Digital Literacy: Many people, especially in rural areas, are not familiar with using digital payment methods.

- Infrastructure Challenges: Stable internet connections and smartphones are not available everywhere, making digital payments difficult.

- Security Concerns: Some people are wary of digital payment security, preferring the perceived safety of cash.

- Convenience for Small Transactions: For small, everyday purchases like buying vegetables or paying for public transport, cash is often quicker and easier.

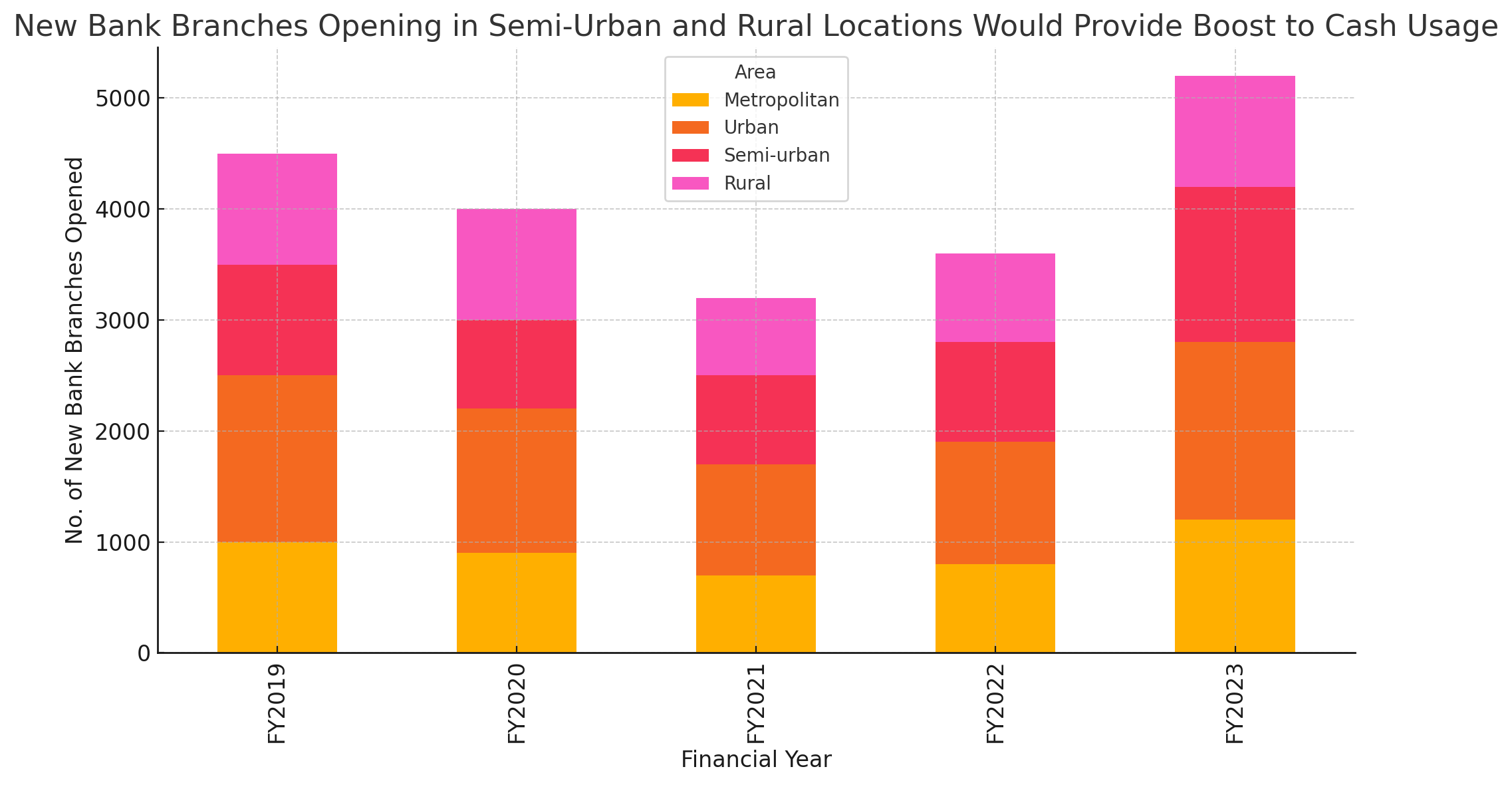

- Increase in Bank Branches: The opening of new bank branches, particularly in semi-urban and rural locations, is expected to provide a boost to cash usage. These areas are likely to benefit the most from increased access to banking services, which can facilitate cash transactions.

The Future of Payments in India

As India continues to modernize, cash and digital payments are likely to coexist. The government is expected to focus on financial inclusion initiatives to bridge the digital divide, while companies will work on enhancing the security and convenience of digital payments. Major players like PhonePe and Google Pay will continue to innovate, driving further growth in the digital payment space.

Although digital payments are gaining traction, cash remains a vital part of India’s economy. Balancing the use of both cash and digital payments will ensure financial inclusion and support economic growth. By embracing both methods, India can leverage the strengths of each to create a more inclusive and prosperous future.

Bridging the Digital Divide

Efforts to enhance digital literacy and infrastructure in rural areas are crucial for promoting digital payments. Initiatives by the government and financial institutions to improve internet connectivity and digital payment education can help bridge the gap between urban and rural areas.