In an era where digital payments are increasingly becoming the backbone of economies worldwide, the North East Region (NER) of India stands at a crossroads. Despite showcasing a promising trajectory in digital engagement, the region grapples with unique challenges that slow down its full-scale digital transformation. Yet, with targeted strategies and collaborative efforts, there lies a significant opportunity to catalyze responsible digital payments across the NER, unlocking not just economic growth but also advancing sustainable development goals.

The Bright Spots of Digital Engagement in NER:

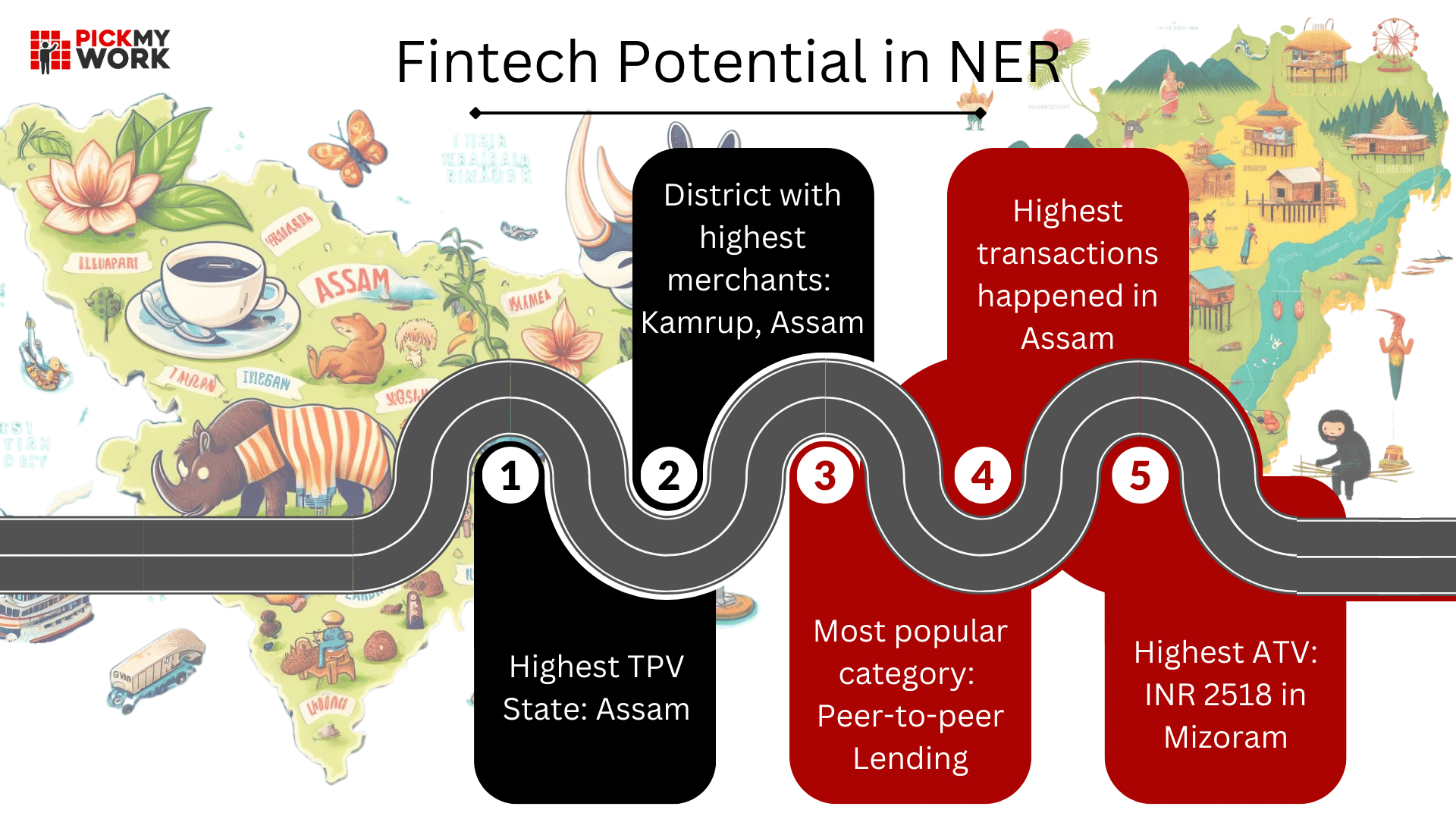

The NER, often celebrated for its rich culture and breathtaking landscapes, is also marking its presence in the digital payment landscape. Here are some encouraging signs:

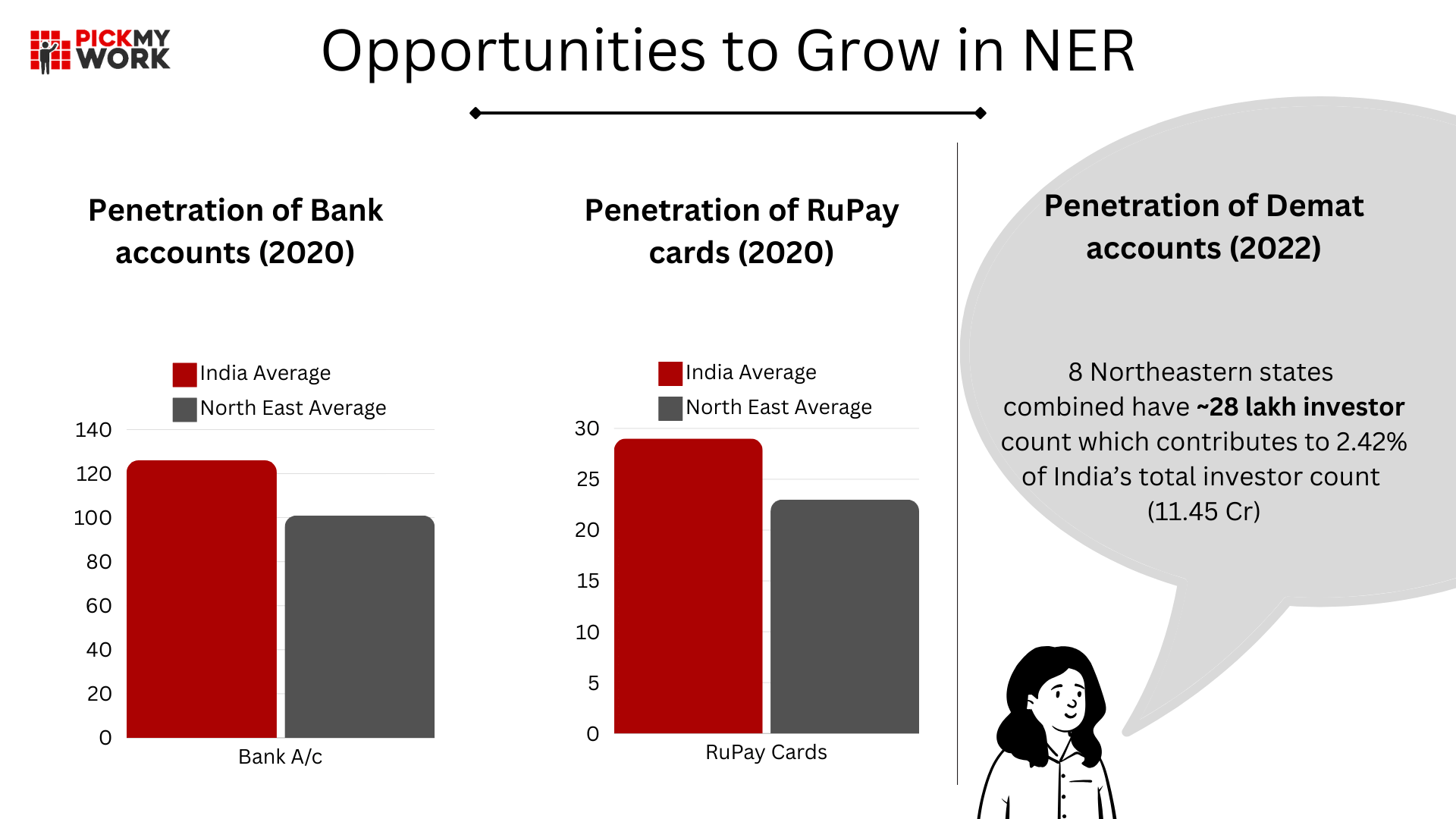

- Banking and Card Usage: Almost every household in the NER has a bank account, with a notable 26% of residents owning a RuPay card, slightly above the national average. This foundational banking penetration is a critical first step towards embracing digital payments.

- Smartphone and Internet Access: With 47% smartphone ownership, the region is on par with the national average. This access is crucial for digital payment solutions, which often rely on smartphone applications.

It is interesting to note that in India, women are less likely to own a mobile phone and 50% less likely to access mobile internet. And, this difference is less pronounced in the North East Region.

Addressing the Core Challenges:

Despite these promising indicators, three primary hurdles stand in the way of fully realizing the digital potential of the NER:

- Connectivity Issues: The region experiences network downtime up to three times that of India’s metro cities and faces internet speeds 50% slower than the national average. This not only affects the reliability of digital transactions but also deters their adoption.

- Limited CICO Infrastructure: The penetration of ATMs and Business Correspondents (BCs) is significantly lower than the national average, which challenges the conversion of cash into digital formats, especially in rural areas.

- Aadhaar Penetration: The backbone of India’s digital identity system has lower penetration in Assam, the largest state in the NER, limiting fintechs’ ability to onboard merchants efficiently.

Merchant Hesitancy: A Glimpse into the Ground Reality

The hesitancy among merchants to adopt digital payments is another layer of the challenge. Take the case of a merchant, an apparel and vegetable seller in NER, who despite using digital payments for personal transactions, does not accept them at her store due to limited customer demand and fear of technological errors.

A Call to Action: Unleashing the Digital Payment Revolution in NER

The journey towards a fully digitized NER requires a multi-faceted approach, focusing on infrastructure, awareness, and incentives:

- Enhancing Connectivity and Digital Identity: Increasing telecom connectivity and Aadhaar penetration, especially in states like Assam, Meghalaya, and Nagaland, is fundamental.

- Government-led Initiatives: Leveraging 11,700 government-supported common service centres to promote digital payments can catalyze expanding the merchant acceptance network.

- Targeted Incentives: Incentive programs for rural areas and women merchants, aiming for a 50-60% increase in merchant digitization, can significantly drive adoption.

- Data-Driven Interventions: Investing in regional and gender-disaggregated data can inform tailored interventions that address the unique needs of the NER’s diverse population.

Merchants find it difficult to use available digital payment solutions:

- Complex user interface: Current payment applications have multiple touch points/clicks. Each additional click increases user friction with the application, potentially leading to limited or no use.

- Lack of payment applications using local languages: 12 Users often find it difficult to understand and learn a new application if it is not in their local language. The lack of a clear and easy-to-use interface makes it difficult to navigate applications and decipher information hierarchy.

- High machine and maintenance costs: Merchants using PoS and Aadhaar-enabled payment systems incur a cost of ₹300–500 in monthly rentals. Given the low volume of digital payments and thin margins, these costs are seen as eroding profits. (The cost of acquiring a merchant in the NER is 2X compared to other parts of India)

As the Government of India champions the “Act East” policy, prioritizing the digital transformation of the NER becomes not just an economic imperative but a catalyst for inclusive growth. By addressing the connectivity, infrastructure, and awareness challenges head-on and leveraging the power of collaboration and innovation, the NER can leapfrog into a future where digital payments are not just a convenience but a way of life, fostering economic empowerment and sustainable development across one of India’s most vibrant regions.