Unified Payments Interface (UPI) has transformed the way we transact digitally, offering a seamless and secure method for online payments. With the introduction of the RuPay Credit Cards on UPI transactions, users now have an even broader platform for financial transactions, integrating the benefits of credit cards with the ease of UPI payments. This integration caters to a digitally enabled credit card lifecycle experience, enhancing the convenience for customers and expanding the credit ecosystem for merchants through asset lite QR codes.

Making UPI More Relevant for Credit Card Users

Linking RuPay Credit Cards with UPI significantly enriches India’s digital payments landscape, appealing to credit card users by offering them a chance to earn rewards and cashback on a wider range of transactions. This integration extends UPI’s functionality, enabling credit transactions on everyday purchases and increasing the system’s relevance for those who value credit benefits like deferred payments and reward points. Essentially, this move not only enhances the utility and adoption of the RuPay network but also positions UPI as a crucial tool for those seeking to maximize their financial rewards, promoting a more rewarding digital financial ecosystem.

Let’s dive into the process of linking your RuPay Credit Card with UPI and explore the benefits it brings.

Why Link Your RuPay Credit Card with UPI?

Linking your RuPay Credit Card with UPI offers a multitude of advantages:

- Simplified Payments: Make payments directly by scanning UPI QR codes, eliminating the need for physical cards or entering card details online.

- Enhanced Security: Payments are authenticated using a UPI PIN, ensuring a secure transaction environment.

- Exclusive Rewards: Leverage your credit card’s rewards, cashback offers, and discounts while enjoying the convenience of UPI payments.

- Ease of Management: Track your payments, check balances, and manage your credit card efficiently through your UPI app.

Step-by-Step Guide to Link RuPay Credit Card with UPI

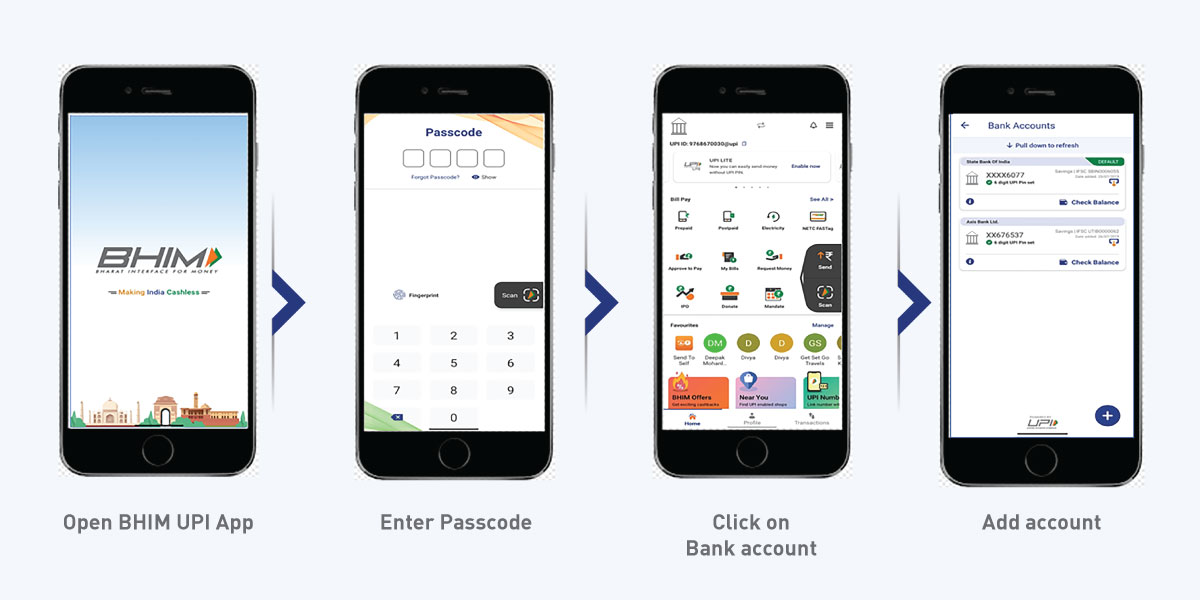

- Download a UPI-Enabled App: Start by downloading any UPI-enabled app like BHIM, PayZapp, Google Pay, etc., from your respective app store.

- Registration: Register on the app using your mobile number linked to your bank account.

- Linking Your Credit Card: Navigate to the ‘Accounts and Cards’ or equivalent section, select ‘Add New’, and choose RuPay Credit Card. Enter your card details including the last six digits and the expiry date.

- OTP Verification: Upon entering your card details, you’ll receive an OTP on your registered mobile number. Enter this OTP to proceed.

- Set UPI PIN: Finally, set a UPI PIN. Ensure this PIN is unique and not shared with anyone.

Click here to apply for amazing RuPay cards on PickMyWork.

Do’s and Don’ts for a Seamless Experience

Do’s:

- Allow the UPI app access to SMS, contacts, and call history for smooth linking.

- Set a distinct UPI PIN for credit card transactions.

- Use your RuPay Credit Card for merchant payments via QR codes and e-commerce transactions.

- Keep your mobile number updated with your issuing bank.

Don’ts:

- Never share your UPI or card PIN with anyone.

- Avoid using the same PIN for multiple purposes.

- Do not share OTPs received during the registration process.

- Stay within your credit limit when making payments.

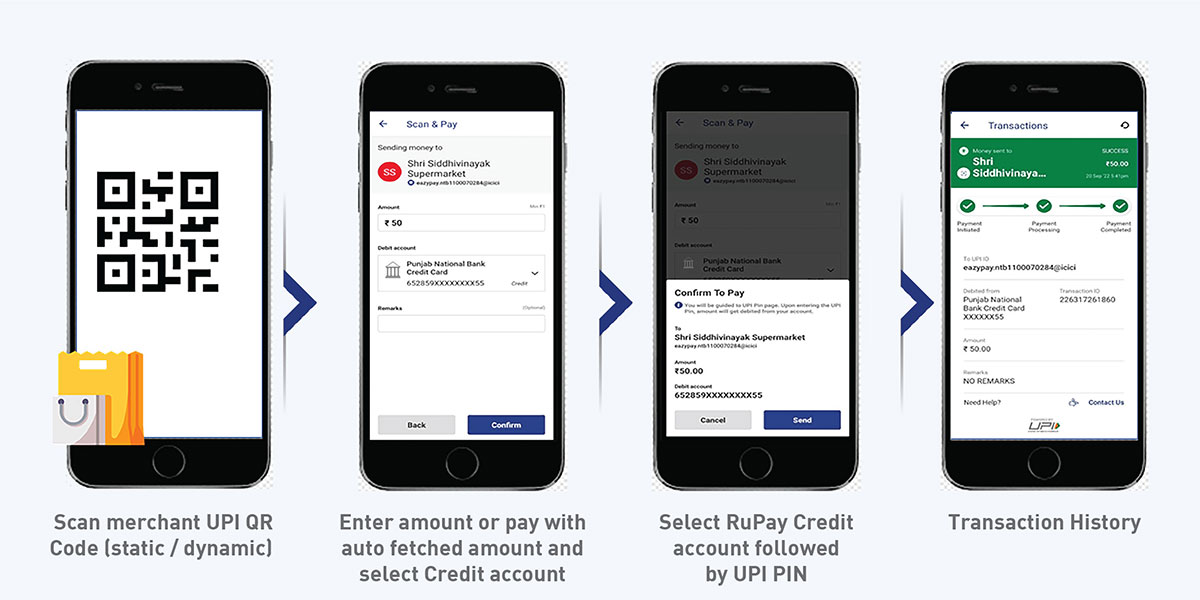

- Making Payments with Your Linked RuPay Credit Card

Making a payment is straightforward

- Open your UPI app and navigate to the payment section.

- Select the RuPay Credit Card linked as your payment method.

- Enter the amount, add a remark if necessary, and authenticate the transaction with your UPI PIN.

Linking your RuPay Credit Card with UPI simplifies your payment process and enhances security and rewards. With apps like PayZapp offering a smooth linkage process, managing credit card payments through UPI has always been challenging. As digital transactions continue to evolve, embracing these advancements will ensure a secure, rewarding, and efficient payment experience.