Welcome, to the exciting world of investing in the digital era! No more paperwork or endless hassles. Say hello to Demat accounts – your gateway to hassle-free wealth creation! If you’re wondering what a Demat account is and why you need it, fear not! We’ve got your back with this fun guide.

The Quest for Wealth: Your Journey Begins

Imagine a genie granting you your wish of good return on your investment.. Your Demat account is just that – guiding you through the exciting world of equity and mutual fund investments.

Opening the Demat Account: It’s a Breeze!

Don’t worry, opening a Demat account is as easy as pie! Just choose a trusty Depository Participant (DP).

A Depository Participant is like an agent of a depository, such as NSDL or CDSL. They get a license to operate from a depository, and you’ll need to approach one to open a Demat account if you’re new to the stock market.

All you need is:

- Proof of identity,

- Proof of residence, and

- A broker agreement.

Adventure awaits! (It might take time 2 to 7 days, but it’s worth it!)

The Cost of Fun: Annual Maintenance Fee and Beyond

In the world of Demat accounts, there are fees to pay, but don’t worry, we’ve got some secrets to share! Meet the wondrous BSDA Demat account.

A Basic Service Demat Account is a demat account intended for small investors who do not or cannot regularly invest in stocks, bonds, ETFs, mutual funds, etc. The BSDA can be maintained at a reduced cost.

A demat account is automatically considered a BSDA if the following conditions are met:

- If only 1 demat is registered with that PAN across brokers.

- The value of the holdings in the demat account is less than ₹2,00,000. A low-cost saviour for investments below Rs. 2 lakh.

Nominate, Transfer, and Conquer

Just like you choose a trusted ally for your marriage, make a nominee for your Demat account. Your spouse, children, or anyone can inherit your holdings! Transferring shares to loved ones is a breeze, and you might even skip capital gains tax if they’re related.

Safe and Secure: Demat’s Fort of Fraud-Fighting

With Demat by your side, you’re protected from duplicate certificates, forged signatures, and smart fraudsters. Your investments are shielded by multiple layers of security with the seamless link between your bank, Demat, and trading accounts. Sleep well, fearless investor!

Administrative Alchemy: From Address Changes to Phone Number Charms

No more writing endless letters for address changes! You inform your Depository Participant on any change, and all your records are updated. Change your phone number or email? No worries – your Demat account works its administrative magic!

SIP: Your Worry-Free Ticket to Prosperity

Still unsure about Equity Investments? Don’t have enough time and knowledge about the share market?

Fear not, for there’s a silver lining in this cloudy market sky! Enter the systematic investment plan, or SIP – your worry-free ticket to prosperity! No more stressing over market conditions or sacrificing goats to the trading gods. SIP has got your back! Take control of your investments, choose your entry and exit points, and enjoy the freedom with no lock-in period. It’s like riding a unicorn through a field of rainbows!

How to Begin Your Stock SIP Adventure

Let’s reveal the secret handshake! Choose your desired stock, open the company details like a treasure chest, tap on “Start SIP,” choose your frequency (monthly or weekly), set the SIP day and the amount or number of stocks. Voilà! You’re on your way to SIP success!

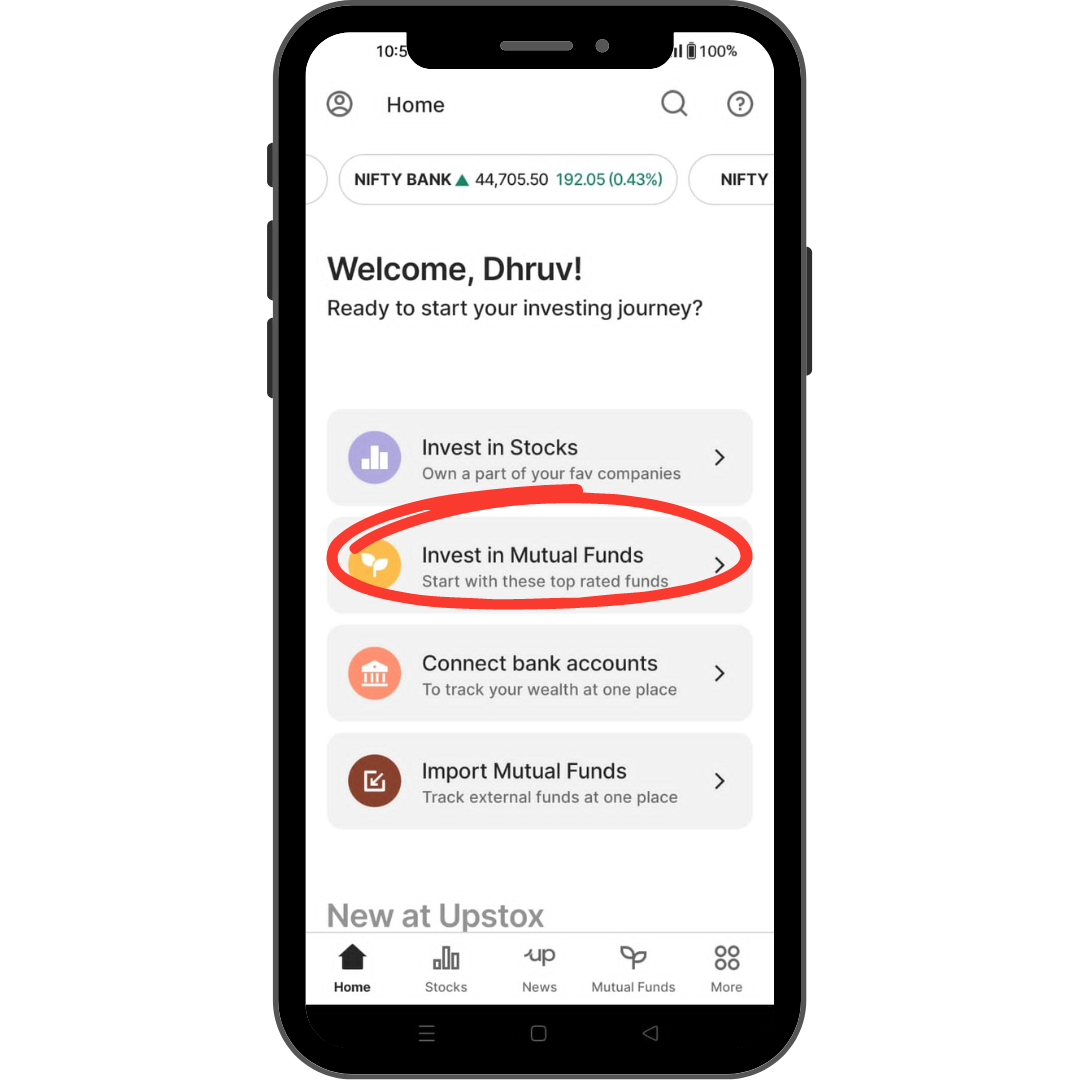

1: Try with Upstox

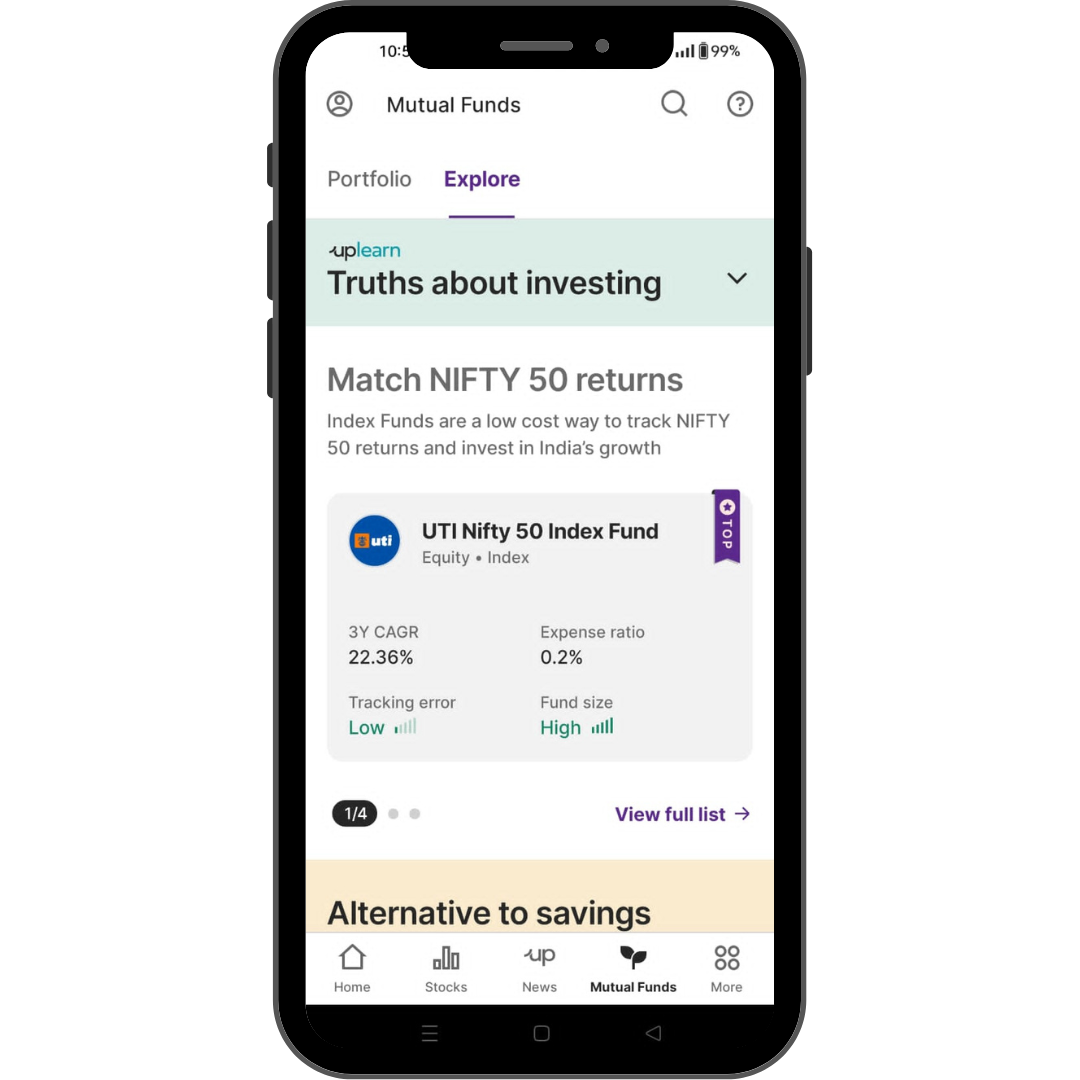

2: Select a low risk high returning asset to start with

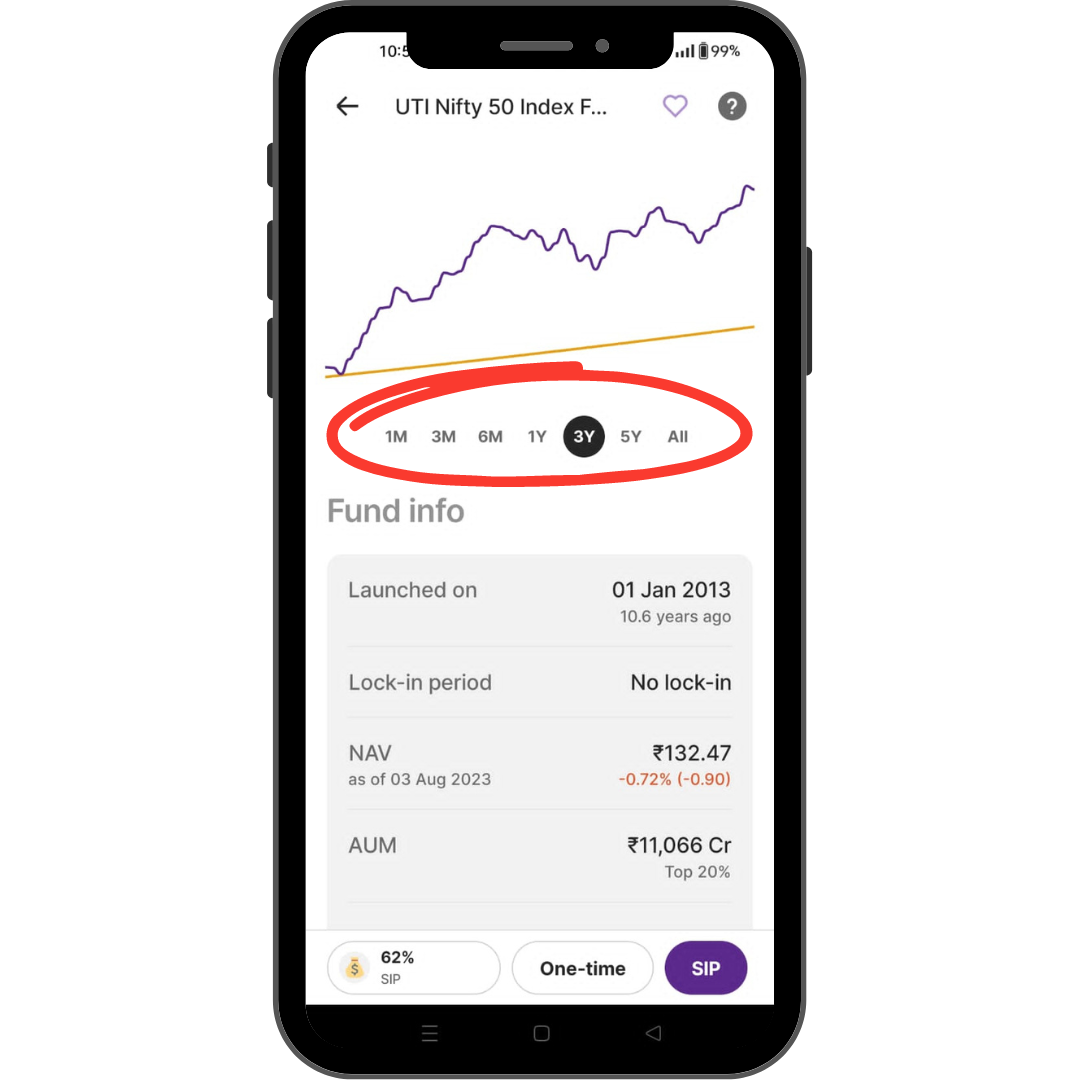

3: You can analyze the amount you will gain in different durations of investment

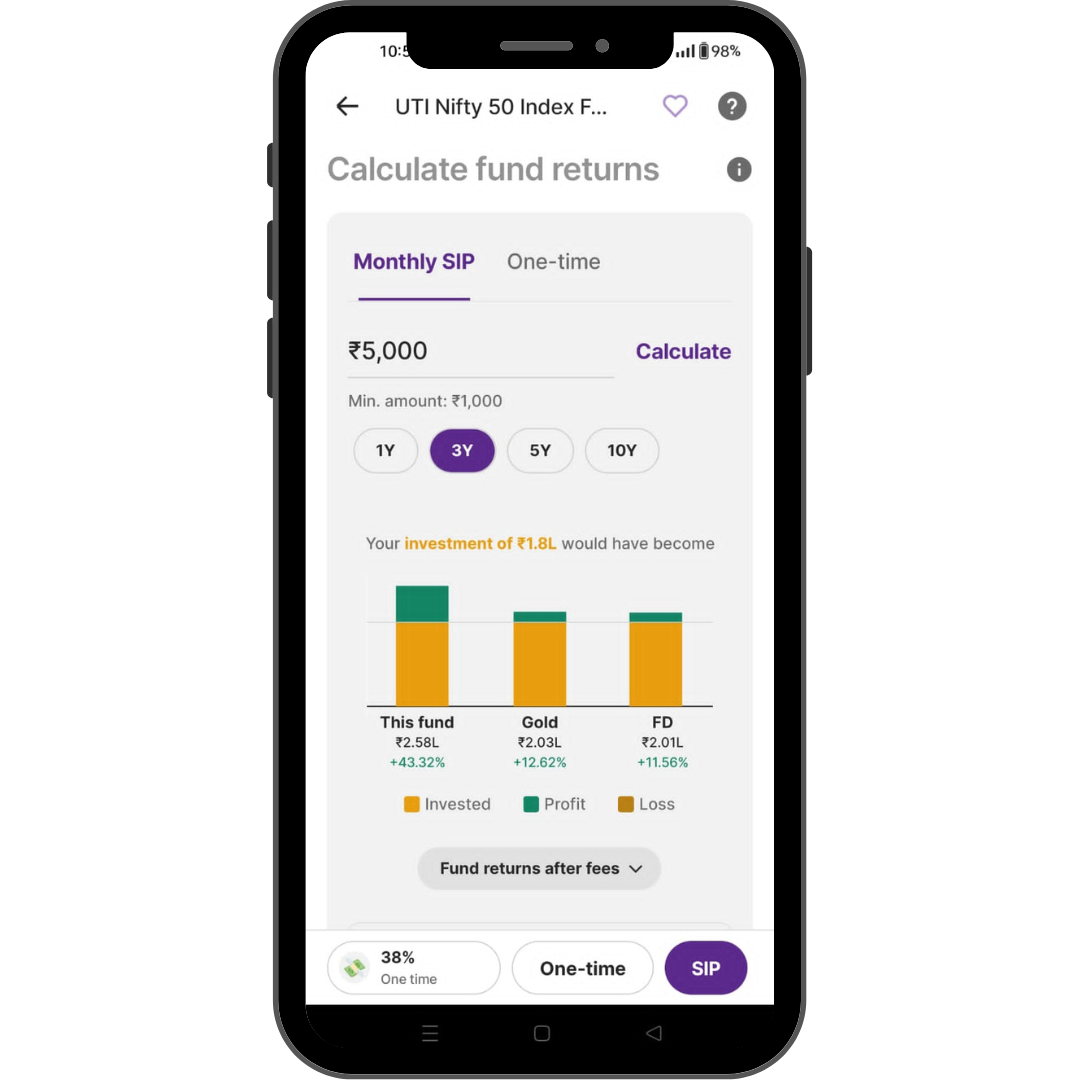

4: Calculate your returns with amount and duration you decide to invest

Click here to learn more.

The Magical World of Investing Money

And there you have it, brave adventurers! Demat accounts unlock a realm of financial opportunities with cost-effectiveness, convenience, and security. Buckle up and embark on your financial odyssey with a Demat account and SIP as your trusted companions. Happy investing!